Linear Regression

Table of Contents

Notes

Accuracy

- Residual sum of squares (RSS) = \(\sum_{i=1}^n (y_i - \hat{y}_i)^2\).

- Residual standard error (RSE) = \(\sqrt{\frac{1}{n-2}\text{RSS}}\).

- \(R^2\) = 1 - \(\frac{\text{RSS}}{\text{TSS}}\).

- Total sum of squares (TSS) = \(\sum_{i=1}^n (y_i - \bar{y}_i)^2\).

Outliers & High Leverage points

- Outlier is an observation for which the predicted response is far from the recorded response.

- High leverage point is an observation for which the recorded predictors are unusual.

- High leverage points usually have more influence on the model than outliers.

- The studentized (standardized) residuals are typically expected to be between -3 and 3. If they lie outside then that indicates that there might be outliers in the data.

- The average leverage is \((p + 1) / n\). If the leverage of some observation is significantly higher than the average leverage then that is a high leverage point. (Look in to "Cook's distance".)

Exercises

Question 1

Since there are three p-values in Table 3.4, there are three null hypotheses:

- H0(1):

salesdoes not depend onTV - H0(2):

salesdoes not depend onradio - H0(3):

salesdoes not depend onnewspaper

The p-values corresponding to the first two null hypotheses are very small, less

than 10-4, whereas the p-value for the last one is close to 1. This means that

the probability of seeing the observed sales numbers if H0(1) or H0(2) is true

is almost zero, but the probability of seeing the observed sales numbers if

H0(3) is true is almost 1. In other words sales depends on TV and radio

but not on newspaper.

Question 2

A KNN classifier classifies an observation is to the class with the majority of nearest neighbors. In the KNN regression method the response is estimated as the average of all the training responses of the nearest neighbors.

Question 3

- Assuming X4 = X1 X2 and X5 = X1 X3, the linear fit model is as follows: Y = 50 + 20 X1 + 0.07 X2 + 35 X3 + 0.01 X1 X2 - 10 X3 X5. Since X3 (Gender) is 1 for females and 0 for males, this fit essentially gives two models based on the gender: Y = 85 + 10 X1 + 0.07 X2 + 0.01 X1 X2 for females, and Y = 50 + 20 X1 + 0.07 X2 + 0.01 X1 X2 for males. If X1 (GPA), and X2 (IQ), are fixed for the two genders then the starting salary for males will be more on average than the starting salary of females if X1 > 35 / 10 = 3.5; i.e. given the GPA is high enough, on average males will have a higher starting salary than females (iii).

- If IQ is 110 and GPA is 4.0 then a female is predicted to have a starting salary of $ 137,100.

- False. The scale for IQ is much larger than that of GPA or Gender. Hence the coefficients related to any IQ based predictor are expected to be small. (Possibly this is why it is often recommended to scale the predictors, so they are all on an equal footing and it is easier to figure out which ones are important.)

Question 4

- Even though the true relationship is linear, we need to take into account the irreducible error \(ϵ\). The cubic model is more flexible than the linear model and therefore will be able to better fit to the irreducible error. I expect the cubic model to have lower training RSS than the linear model.

- The linear model will have a lower test RSS than the cubic model since it matches the true relationship. The cubic model would have overfitted to the irreducible error in the training data and therefore perform worse on the test data.

- Irrespective of the true relationship I would expect the cubic model to have lower training RSS than the linear model because it is more flexible than the linear model and thus fits the training data better.

- Since we do not the true relationship between X and Y, it is difficult to say which of the two models will have lower test RSS without more information.

Question 5

We just have to substitute equation 3.38 in to the equation for the \(i\)th fitted value and rearrange the equation:

\begin{align} a_{i'} = \frac{x_i x_{i'}}{\sum_{k=1}^n x_k^2}. \end{align}Question 6

The equation for the least squares line is \(y = \hat{\beta}_0 + \hat{\beta}_1 x\). From equation 3.4 we have \(\hat{\beta}_0 = \bar{y} - \hat{\beta}_1 \bar{x}\). Then putting \(x = \bar{x}\) in the least squares line equation we see that \(y = \bar{y}\). Thus the least squares line always passes through \((\bar{x}, \bar{y})\).

Question 7

Assumption: \(\bar{x} = \bar{y} = 0\). From equation 3.4 we have \(\hat{y}_i = \hat{\beta}_1 x_i\), where

\begin{align} \hat{\beta}_1 = \frac{\sum_{i=1}^n x_i y_i}{\sum_{i=1}^n x_i^2}. \end{align}And from equation 3.17 we have

\begin{align} R^2 = 1 - \frac{\sum_{i=1}^n (y_i - \hat{y}_i)^2}{\sum_{i=1}^n y_i^2}. \end{align}Expanding the square in the numerator of the above fraction and substituting \(\hat{y}_i\) with \(\hat{\beta}_1 x_i\) we get

\begin{align} R^2 = \frac{\hat{\beta}_1(2 \sum_{i=1}^n x_iy_i - \hat{\beta}_1 \sum_{i=1}^n x_i^2)}{\sum_{i=1}^n y_i^2}. \end{align}Now if we simply substitute the above form of \(\hat{\beta}_1\) in to this equation we will see that \(R^2 = \mathrm{Cor}(X, Y)^2\), where \(\mathrm{Cor}(X, Y)\) is given by equation 3.18.

Question 8

Simple linear regression on Auto data set

import pandas as pd import numpy as np from tabulate import tabulate auto = pd.read_csv("data/Auto.csv") print(tabulate(auto.head(), auto.columns, tablefmt="orgtbl"))

| | mpg | cylinders | displacement | horsepower | weight | acceleration | year | origin | name | |----+-------+-------------+----------------+--------------+----------+----------------+--------+----------+---------------------------| | 0 | 18 | 8 | 307 | 130 | 3504 | 12 | 70 | 1 | chevrolet chevelle malibu | | 1 | 15 | 8 | 350 | 165 | 3693 | 11.5 | 70 | 1 | buick skylark 320 | | 2 | 18 | 8 | 318 | 150 | 3436 | 11 | 70 | 1 | plymouth satellite | | 3 | 16 | 8 | 304 | 150 | 3433 | 12 | 70 | 1 | amc rebel sst | | 4 | 17 | 8 | 302 | 140 | 3449 | 10.5 | 70 | 1 | ford torino |

Recall from the last chapter horsepower has some missing values and needs to

be converted to a numeric form before we can use this for linear regression.

auto.drop(auto[auto.horsepower == "?"].index, inplace=True) auto["horsepower"] = pd.to_numeric(auto["horsepower"])

For simple linear regression we can use the ordinary least squares model from

statsmodels or the linear regression model from scikit-learn. In this

question we are asked to print the summary of the fitted model. scikit-learn

has no method for generating a summary, but statsmodels does.

import statsmodels.formula.api as smf model = smf.ols(formula="mpg~horsepower", data=auto).fit() print(model.summary())

OLS Regression Results

==============================================================================

Dep. Variable: mpg R-squared: 0.606

Model: OLS Adj. R-squared: 0.605

Method: Least Squares F-statistic: 599.7

Date: Mon, 25 May 2020 Prob (F-statistic): 7.03e-81

Time: 17:19:34 Log-Likelihood: -1178.7

No. Observations: 392 AIC: 2361.

Df Residuals: 390 BIC: 2369.

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 39.9359 0.717 55.660 0.000 38.525 41.347

horsepower -0.1578 0.006 -24.489 0.000 -0.171 -0.145

==============================================================================

Omnibus: 16.432 Durbin-Watson: 0.920

Prob(Omnibus): 0.000 Jarque-Bera (JB): 17.305

Skew: 0.492 Prob(JB): 0.000175

Kurtosis: 3.299 Cond. No. 322.

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

- The F-statistic is much larger than 1, and the p-value (

P>|t|in the table) is zero. This indicates that there is a relationship betweenmpgandhorsepower. - The \(R^2\) value of 0.606 indicates that this relationship explains around

61% of the

mpgvalues. - The coefficient value corresponding to

horsepoweris negative. This indicates that the relation betweenmpgandhorsepoweris negative. pred = model.get_prediction(exog=dict(horsepower=98)) pred_summary = pred.summary_frame() print(tabulate(pred_summary, pred_summary.columns, tablefmt="orgtbl"))

| | mean | mean_se | mean_ci_lower | mean_ci_upper | obs_ci_lower | obs_ci_upper | |----+---------+-----------+-----------------+-----------------+----------------+----------------| | 0 | 24.4671 | 0.251262 | 23.9731 | 24.9611 | 14.8094 | 34.1248 |

The predicted

mpgforhorsepower= 98 is 24.4671. The 95% confidence interval is \([23.9731, 24.9611]\), and the 95% prediction interval is \([14.8094, 34.1248]\). As mentioned in the text, the prediction interval contains the confidence interval.

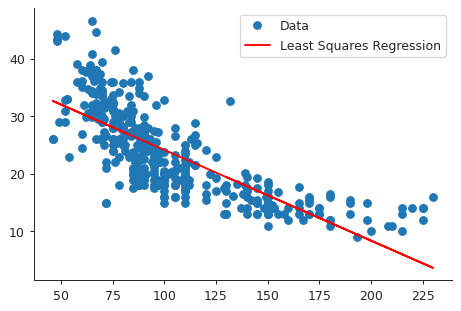

Least squares plot

import matplotlib.pyplot as plt import seaborn as sns sns.set_style("ticks") X = auto["horsepower"] Y = auto["mpg"] Ypred = model.predict(X) plt.close("all") fig, ax = plt.subplots() ax.plot(X, Y, 'o', label="Data") ax.plot(X, Ypred, 'r', label="Least Squares Regression") ax.legend(loc="best") sns.despine() fig.savefig("img/3_auto_ls.png", dpi=90)

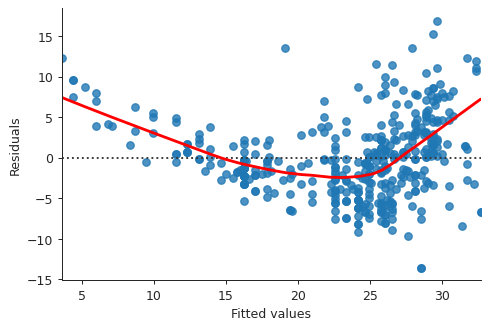

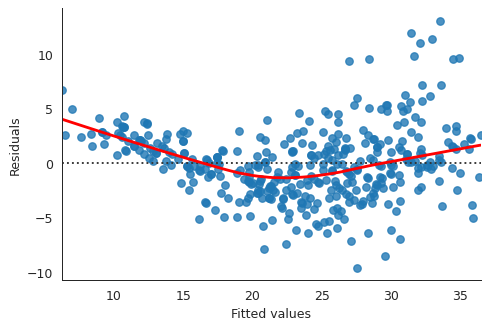

Diagnostic plots

The R command plot in this case gives four diagnostic plots:

- Residuals vs Fitted

- Normal Q-Q

- Scale-Location

- Residuals vs Leverage

The Residuals vs Fitted plot shows any non-linear pattern in the residuals, and by extension in the data. The Normal Q-Q plot shows if the residuals are normally distributed. The Scale-Location plot shows if there is heteroscedasticity. The Residuals vs Leverage plot shows if there are leverages in the data.

We will produce these plots using statsmodels and seaborn.

- Residuals vs Fitted plot

fitted_vals = model.fittedvalues plt.close("all") fig, ax = plt.subplots() residplot = sns.residplot(x=fitted_vals, y="mpg", data=auto, lowess=True, line_kws={"color": "red"}, ax=ax) ax.set_xlabel("Fitted values") ax.set_ylabel("Residuals") sns.despine() fig.savefig("img/3_res_vs_fit.png", dpi=90)

This plot clearly shows that there is non-linearity in the data.

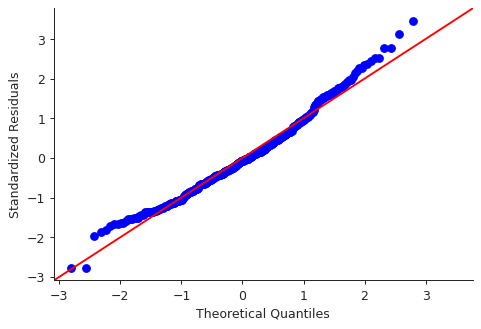

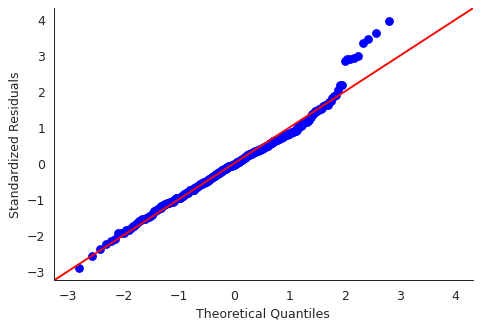

- Normal Q-Q plot

import statsmodels.api as sm residuals = model.resid plt.close("all") fig, ax = plt.subplots() qqplot = sm.qqplot(residuals, line='45', ax=ax, fit=True) ax.set_ylabel("Standardized Residuals") sns.despine() fig.savefig("img/3_auto_qq.png", dpi=90)

Though there are some points that are far from the \(45^\circ\) fitted line, most of the points lie close to the line, indicating that the residuals are mostly normally distributed.

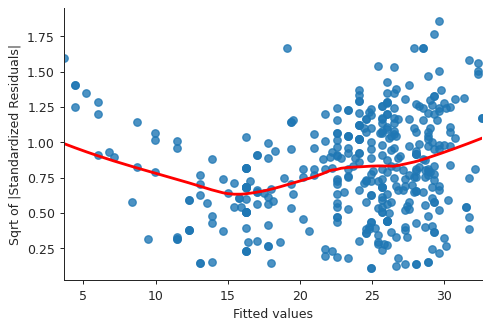

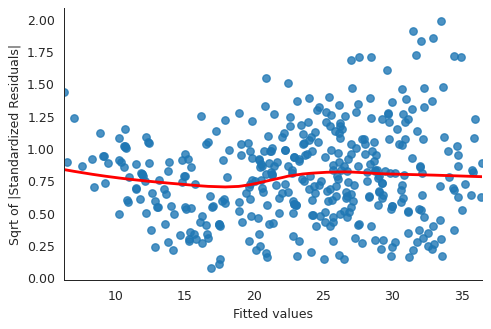

- Scale-Location plot

# normalized residuals and their square roots norm_residuals = model.get_influence().resid_studentized_internal norm_residuals_abs_sqrt = np.sqrt(np.abs(norm_residuals)) plt.close("all") fig, ax = plt.subplots() slplot = sns.regplot(fitted_vals, norm_residuals_abs_sqrt, lowess=True, line_kws={"color" : "red"}, ax=ax) ax.set_xlabel("Fitted values") ax.set_ylabel("Sqrt of |Standardized Residuals|") sns.despine() fig.savefig("img/3_auto_scale_loc.png", dpi=90)

This plot is similar to the first diagnostic plots, except now the quantity on the y-axis is positive. This shows that homoscedasticity is not held, i.e. the variance is not constant.

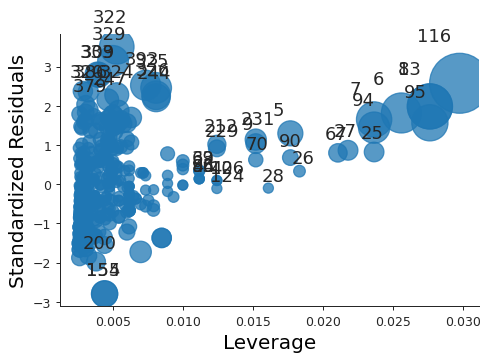

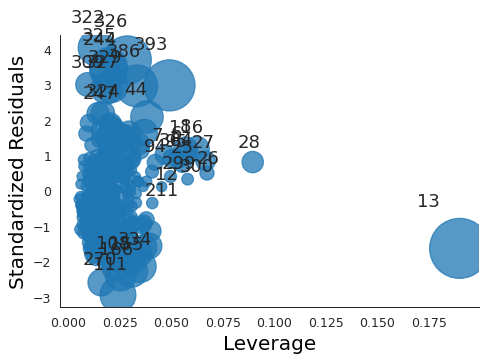

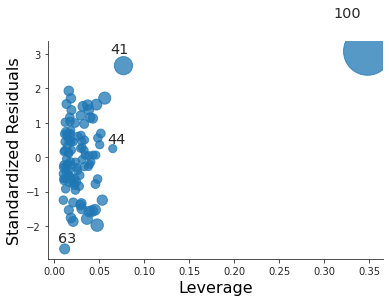

- Residuals vs Leverage plot

plt.close("all") fig, ax = plt.subplots() rlplot = sm.graphics.influence_plot(model, criterion="Cooks", ax=ax) sns.despine() ax.set_xlabel("Leverage") ax.set_ylabel("Standardized Residuals") ax.set_title(" ") fig.savefig("img/3_auto_res_vs_lev.png", dpi=90)

We see that none of the points have a very high leverage.

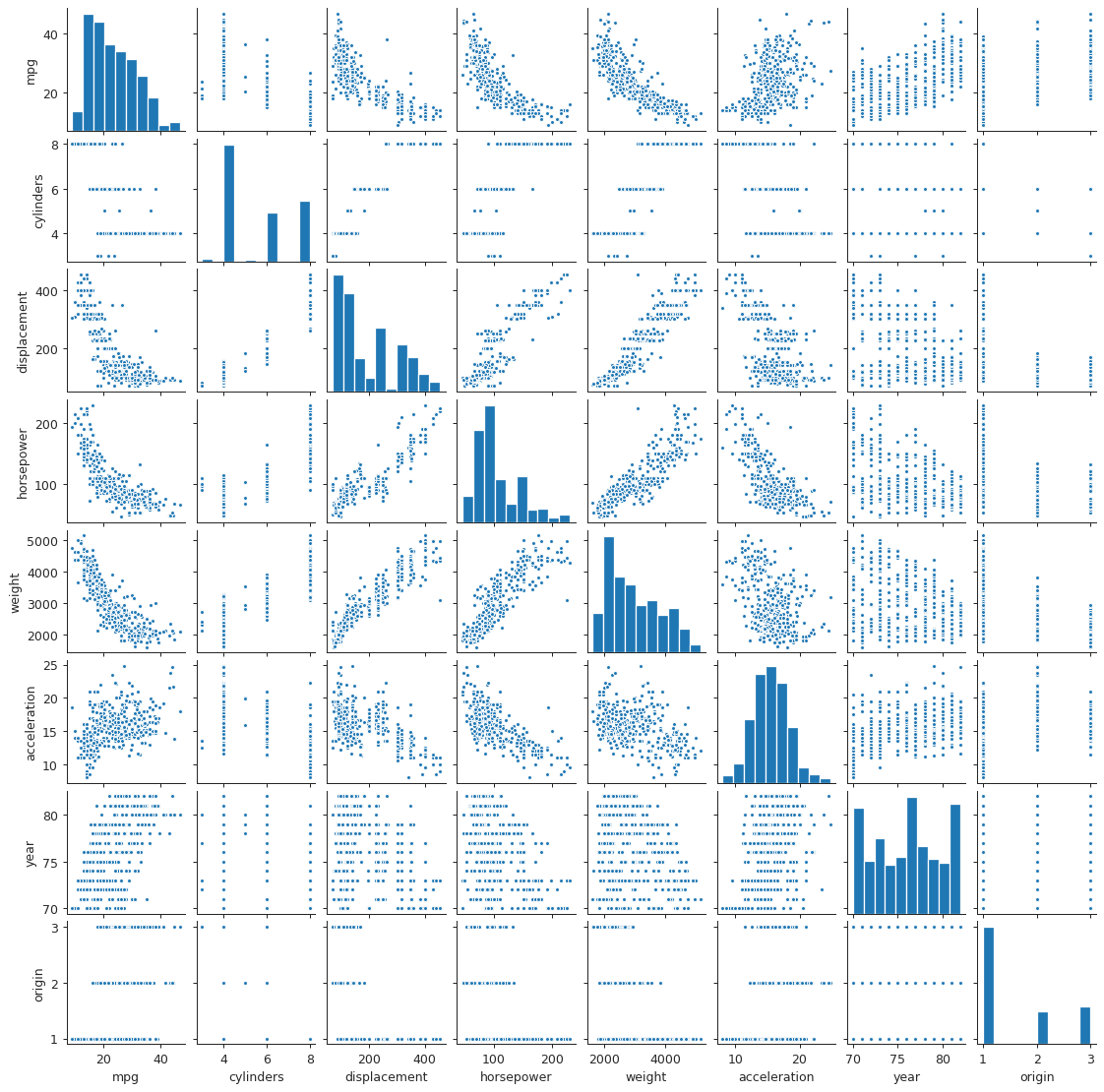

Question 9

Scatter plot matrix of Auto data set

plt.close("all") spm = sns.pairplot(auto, plot_kws = {'s': 10}) spm.fig.set_size_inches(12, 12) spm.savefig("img/3_auto_scatter.png", dpi=90)

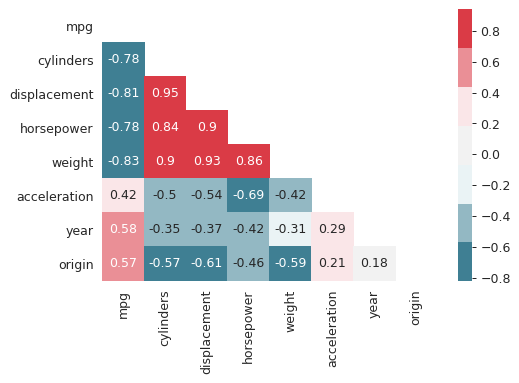

Correlation matrix

I find heat maps to be better for visualizing correlation matrices than tables. Since the correlation matrix is symmetric we can ignore either of the lower or the upper triangles. We can also ignore the diagonal since it is always going to be 1.

corr_mat = auto[auto.columns[:-1]].corr() plt.close("all") fig, ax = plt.subplots() # Custom diverging color map. cmap = sns.diverging_palette(220, 10, sep=80, n=7) # Mask for upper triangle. mask = np.triu(np.ones_like(corr_mat, dtype=np.bool)) with sns.axes_style("white"): sns.heatmap(corr_mat, mask=mask, cmap=cmap, annot=True, robust=True, ax=ax) fig.savefig("img/3_auto_corr_heat.png")

We see that mpg has considerable negative correlations with cylinders,

displacement, horsepower, and weight. This matches what we saw in the

scatter plot matrix above. Similarly cylinders, displacement, horsepower

and weight are all correlated with each other.

Multiple linear regression with Auto data set

We could do this with the statsmodels.formula API but that involves more

typing, so we will use the statsmodels API.

import statsmodels.api as sm Y = auto["mpg"] X = auto[auto.columns[1:-1]] X = sm.add_constant(X) # For the intercept. ml_model = sm.OLS(Y, X).fit() print(ml_model.summary())

OLS Regression Results

==============================================================================

Dep. Variable: mpg R-squared: 0.821

Model: OLS Adj. R-squared: 0.818

Method: Least Squares F-statistic: 252.4

Date: Mon, 25 May 2020 Prob (F-statistic): 2.04e-139

Time: 17:25:25 Log-Likelihood: -1023.5

No. Observations: 392 AIC: 2063.

Df Residuals: 384 BIC: 2095.

Df Model: 7

Covariance Type: nonrobust

================================================================================

coef std err t P>|t| [0.025 0.975]

--------------------------------------------------------------------------------

const -17.2184 4.644 -3.707 0.000 -26.350 -8.087

cylinders -0.4934 0.323 -1.526 0.128 -1.129 0.142

displacement 0.0199 0.008 2.647 0.008 0.005 0.035

horsepower -0.0170 0.014 -1.230 0.220 -0.044 0.010

weight -0.0065 0.001 -9.929 0.000 -0.008 -0.005

acceleration 0.0806 0.099 0.815 0.415 -0.114 0.275

year 0.7508 0.051 14.729 0.000 0.651 0.851

origin 1.4261 0.278 5.127 0.000 0.879 1.973

==============================================================================

Omnibus: 31.906 Durbin-Watson: 1.309

Prob(Omnibus): 0.000 Jarque-Bera (JB): 53.100

Skew: 0.529 Prob(JB): 2.95e-12

Kurtosis: 4.460 Cond. No. 8.59e+04

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 8.59e+04. This might indicate that there are

strong multicollinearity or other numerical problems.

- The large F-statistic indicates that we can ignore the null hypothesis, which

says that the response

mpgdoes not depend on the predictors. The probability that this data could be generated if the null hypothesis was true is essentially zero (2.04E-139). - Looking at the p-values of the individual predictors we see that

weight,year, andoriginhave the most statistically significant relation withmpg. We can also argue thatdisplacementhas a somewhat significant relation withmpg. On the other handcylinders,horsepower, andaccelerationdo not have a significant statistical relationship. This is not necessarily surprising. Given the correlation betweenmpg,displacement,cylindersandhorsepowerI think one can argue that the information incylindersandhorsepoweris redundant. - The coefficient for the

yearvariable suggests that every year thempgincreases by0.7508, i.e. the cars become more fuel-efficient every year.

Diagnostic plots

We make the same diagnostic plots as the previous exercise.

- Residuals vs Fitted plot

fitted_vals = ml_model.fittedvalues plt.close("all") fig, ax = plt.subplots() residplot = sns.residplot(x=fitted_vals, y="mpg", data=auto, lowess=True, line_kws={"color": "red"}, ax=ax) ax.set_xlabel("Fitted values") ax.set_ylabel("Residuals") sns.despine() fig.savefig("img/3_ml_res_vs_fit.png", dpi=90)

This plot clearly shows that there is non-linearity in the data.

- Normal Q-Q plot

import statsmodels.api as sm residuals = ml_model.resid plt.close("all") fig, ax = plt.subplots() qqplot = sm.qqplot(residuals, line='45', ax=ax, fit=True) ax.set_ylabel("Standardized Residuals") sns.despine() fig.savefig("img/3_ml_auto_qq.png", dpi=90)

Though there are some points that are far from the \(45^\circ\) fitted line, most of the points lie close to the line, indicating that the residuals are mostly normally distributed.

- Scale-Location plot

# normalized residuals and their square roots norm_residuals = ml_model.get_influence().resid_studentized_internal norm_residuals_abs_sqrt = np.sqrt(np.abs(norm_residuals)) plt.close("all") fig, ax = plt.subplots() slplot = sns.regplot(fitted_vals, norm_residuals_abs_sqrt, lowess=True, line_kws={"color" : "red"}, ax=ax) ax.set_xlabel("Fitted values") ax.set_ylabel("Sqrt of |Standardized Residuals|") sns.despine() fig.savefig("img/3_ml_auto_scale_loc.png", dpi=90)

The variance in the standardized residuals is less as compared to the single regression plot, but there is still quite a bit of variance, which means homoscedasticity is not held.

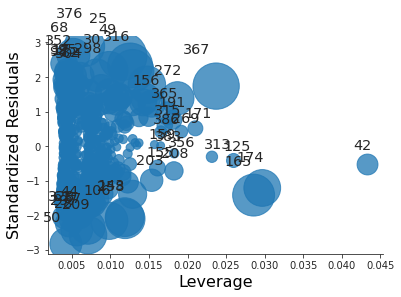

- Residuals vs Leverage plot

plt.close("all") fig, ax = plt.subplots() rlplot = sm.graphics.influence_plot(ml_model, criterion="Cooks", ax=ax) sns.despine() ax.set_xlabel("Leverage") ax.set_ylabel("Standardized Residuals") ax.set_title(" ") fig.savefig("img/3_ml_auto_res_vs_lev.png", dpi=90)

Point 13 has a high leverage but not a very high residual.

Interaction effects

We go back to the statsmodels.formula API. Additionally I will drop

cylinders, horsepower, and acceleration from the model. I will try the

following interaction terms:

year : origin: this will add a new predictor which is a product ofyearandorigin, but will not includeyearandoriginseparately,year * origin: this will add the product ofyearandorigin, but also includeyearandoriginseparately,year * weight: same as the above, except forweightin place oforigin.

ml_model_1 = smf.ols(formula="mpg ~ displacement + weight + year : origin", data=auto).fit() ml_model_2 = smf.ols(formula="mpg ~ displacement + weight + year * origin", data=auto).fit() ml_model_3 = smf.ols(formula="mpg ~ displacement + weight * year + origin", data=auto).fit()

- Summary of first interaction model

print(ml_model_1.summary())

OLS Regression Results ============================================================================== Dep. Variable: mpg R-squared: 0.714 Model: OLS Adj. R-squared: 0.712 Method: Least Squares F-statistic: 322.7 Date: Mon, 25 May 2020 Prob (F-statistic): 4.85e-105 Time: 18:13:04 Log-Likelihood: -1115.9 No. Observations: 392 AIC: 2240. Df Residuals: 388 BIC: 2256. Df Model: 3 Covariance Type: nonrobust ================================================================================ coef std err t P>|t| [0.025 0.975] -------------------------------------------------------------------------------- Intercept 39.8822 1.427 27.939 0.000 37.076 42.689 displacement -0.0100 0.006 -1.728 0.085 -0.021 0.001 weight -0.0056 0.001 -8.137 0.000 -0.007 -0.004 year:origin 0.0193 0.004 4.502 0.000 0.011 0.028 ============================================================================== Omnibus: 41.720 Durbin-Watson: 0.883 Prob(Omnibus): 0.000 Jarque-Bera (JB): 68.034 Skew: 0.674 Prob(JB): 1.69e-15 Kurtosis: 4.532 Cond. No. 2.09e+04 ============================================================================== Warnings: [1] Standard Errors assume that the covariance matrix of the errors is correctly specified. [2] The condition number is large, 2.09e+04. This might indicate that there are strong multicollinearity or other numerical problems.The large F-statistic invalidates the null hypothesis. The individual p-values show that

displacementis not really significant, but the product ofyearandoriginis. Additionally the \(R^2\) value tells us that this model explains around 71% of thempgvalues. - Summary of second interaction model

print(ml_model_2.summary())

OLS Regression Results ============================================================================== Dep. Variable: mpg R-squared: 0.823 Model: OLS Adj. R-squared: 0.821 Method: Least Squares F-statistic: 359.5 Date: Mon, 25 May 2020 Prob (F-statistic): 8.65e-143 Time: 18:17:24 Log-Likelihood: -1021.6 No. Observations: 392 AIC: 2055. Df Residuals: 386 BIC: 2079. Df Model: 5 Covariance Type: nonrobust ================================================================================ coef std err t P>|t| [0.025 0.975] -------------------------------------------------------------------------------- Intercept 7.9270 8.873 0.893 0.372 -9.519 25.373 displacement 0.0016 0.005 0.319 0.750 -0.008 0.011 weight -0.0064 0.001 -11.571 0.000 -0.007 -0.005 year 0.4313 0.113 3.818 0.000 0.209 0.653 origin -14.4936 4.707 -3.079 0.002 -23.749 -5.239 year:origin 0.2023 0.060 3.345 0.001 0.083 0.321 ============================================================================== Omnibus: 38.636 Durbin-Watson: 1.322 Prob(Omnibus): 0.000 Jarque-Bera (JB): 71.804 Skew: 0.584 Prob(JB): 2.56e-16 Kurtosis: 4.741 Cond. No. 1.84e+05 ============================================================================== Warnings: [1] Standard Errors assume that the covariance matrix of the errors is correctly specified. [2] The condition number is large, 1.84e+05. This might indicate that there are strong multicollinearity or other numerical problems.The \(R^2\) value has increased; it is now almost the same as the \(R^2\) value for the model with all the quantitative predictors but no interaction. This model explains around 82% of the

mpgvalues. Additionally we see thatyearis more significant thanoriginor the product ofyearandorigin. Also, in addition todisplacement, the intercept term appears to be insignificant too. - Summary of third interaction model

print(ml_model_3.summary())

OLS Regression Results ============================================================================== Dep. Variable: mpg R-squared: 0.840 Model: OLS Adj. R-squared: 0.838 Method: Least Squares F-statistic: 404.4 Date: Mon, 25 May 2020 Prob (F-statistic): 5.53e-151 Time: 18:22:57 Log-Likelihood: -1002.4 No. Observations: 392 AIC: 2017. Df Residuals: 386 BIC: 2041. Df Model: 5 Covariance Type: nonrobust ================================================================================ coef std err t P>|t| [0.025 0.975] -------------------------------------------------------------------------------- Intercept -107.6004 12.904 -8.339 0.000 -132.971 -82.229 displacement -0.0004 0.005 -0.088 0.930 -0.009 0.009 weight 0.0260 0.005 5.722 0.000 0.017 0.035 year 1.9624 0.172 11.436 0.000 1.625 2.300 weight:year -0.0004 5.97e-05 -7.214 0.000 -0.001 -0.000 origin 0.9116 0.255 3.579 0.000 0.411 1.412 ============================================================================== Omnibus: 43.792 Durbin-Watson: 1.372 Prob(Omnibus): 0.000 Jarque-Bera (JB): 89.759 Skew: 0.619 Prob(JB): 3.23e-20 Kurtosis: 4.991 Cond. No. 1.90e+07 ============================================================================== Warnings: [1] Standard Errors assume that the covariance matrix of the errors is correctly specified. [2] The condition number is large, 1.9e+07. This might indicate that there are strong multicollinearity or other numerical problems.The \(R^2\) increased a bit, and it appears other than

displacementall the other predictors are significant. - Interaction model with two interactions

We will try an additional model with two interactions:

displacement * weightandweight * year.ml_model_4 = smf.ols("mpg ~ displacement * weight + weight * year + origin", data=auto).fit() print(ml_model_4.summary())

OLS Regression Results ============================================================================== Dep. Variable: mpg R-squared: 0.859 Model: OLS Adj. R-squared: 0.856 Method: Least Squares F-statistic: 389.6 Date: Mon, 25 May 2020 Prob (F-statistic): 4.10e-160 Time: 18:33:39 Log-Likelihood: -977.80 No. Observations: 392 AIC: 1970. Df Residuals: 385 BIC: 1997. Df Model: 6 Covariance Type: nonrobust ======================================================================================= coef std err t P>|t| [0.025 0.975] --------------------------------------------------------------------------------------- Intercept -61.3985 13.741 -4.468 0.000 -88.416 -34.381 displacement -0.0604 0.009 -6.424 0.000 -0.079 -0.042 weight 0.0090 0.005 1.848 0.065 -0.001 0.019 displacement:weight 1.708e-05 2.38e-06 7.169 0.000 1.24e-05 2.18e-05 year 1.4982 0.174 8.616 0.000 1.156 1.840 weight:year -0.0002 6.16e-05 -4.037 0.000 -0.000 -0.000 origin 0.3388 0.253 1.342 0.181 -0.158 0.835 ============================================================================== Omnibus: 62.892 Durbin-Watson: 1.412 Prob(Omnibus): 0.000 Jarque-Bera (JB): 174.597 Skew: 0.754 Prob(JB): 1.22e-38 Kurtosis: 5.901 Cond. No. 8.00e+07 ============================================================================== Warnings: [1] Standard Errors assume that the covariance matrix of the errors is correctly specified. [2] The condition number is large, 8e+07. This might indicate that there are strong multicollinearity or other numerical problems.This is interesting. We see that the \(R^2\) value has increased further, but now

displacementhas become significant whereasweightandoriginhave become relatively insignificant. The interaction terms are still significant. My understanding of this model is that whileweightdoes not directly affectmpg, it increasesdisplacement, and that affects thempg.

Models with variable transformations

ml_model_trans = smf.ols(formula="mpg ~ np.log(weight) + np.power(weight, 2) + year", data=auto).fit() print(ml_model_trans.summary())

OLS Regression Results

==============================================================================

Dep. Variable: mpg R-squared: 0.851

Model: OLS Adj. R-squared: 0.850

Method: Least Squares F-statistic: 749.0

Date: Mon, 25 May 2020 Prob (F-statistic): 4.19e-162

Time: 18:49:50 Log-Likelihood: -1001.5

No. Observations: 397 AIC: 2011.

Df Residuals: 393 BIC: 2027.

Df Model: 3

Covariance Type: nonrobust

=======================================================================================

coef std err t P>|t| [0.025 0.975]

---------------------------------------------------------------------------------------

Intercept 213.1803 16.063 13.271 0.000 181.599 244.761

np.log(weight) -32.5971 2.150 -15.159 0.000 -36.825 -28.369

np.power(weight, 2) 6.506e-07 1.12e-07 5.804 0.000 4.3e-07 8.71e-07

year 0.8355 0.044 19.023 0.000 0.749 0.922

==============================================================================

Omnibus: 69.088 Durbin-Watson: 1.361

Prob(Omnibus): 0.000 Jarque-Bera (JB): 168.823

Skew: 0.864 Prob(JB): 2.19e-37

Kurtosis: 5.687 Cond. No. 1.17e+09

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.17e+09. This might indicate that there are

strong multicollinearity or other numerical problems.

The F-statistic and the p-values indicate that these transformations are statistically significant.

Question 10

Multiple regression with Carseats data set

So far I had been loading the data sets from local .csv files, but I recently

found out that statsmodels makes them automatically available using the

Rdatasets project. So going forward I will be using that whenever possible.

import statsmodels.api as sm carseats = sm.datasets.get_rdataset("Carseats", package="ISLR") print(carseats.__doc__)

+----------+-----------------+ | Carseats | R Documentation | +----------+-----------------+ Sales of Child Car Seats ------------------------ Description ~~~~~~~~~~~ A simulated data set containing sales of child car seats at 400 different stores. Usage ~~~~~ :: Carseats Format ~~~~~~ A data frame with 400 observations on the following 11 variables. ``Sales`` Unit sales (in thousands) at each location ``CompPrice`` Price charged by competitor at each location ``Income`` Community income level (in thousands of dollars) ``Advertising`` Local advertising budget for company at each location (in thousands of dollars) ``Population`` Population size in region (in thousands) ``Price`` Price company charges for car seats at each site ``ShelveLoc`` A factor with levels ``Bad``, ``Good`` and ``Medium`` indicating the quality of the shelving location for the car seats at each site ``Age`` Average age of the local population ``Education`` Education level at each location ``Urban`` A factor with levels ``No`` and ``Yes`` to indicate whether the store is in an urban or rural location ``US`` A factor with levels ``No`` and ``Yes`` to indicate whether the store is in the US or not Source ~~~~~~ Simulated data References ~~~~~~~~~~ James, G., Witten, D., Hastie, T., and Tibshirani, R. (2013) *An Introduction to Statistical Learning with applications in R*, `www.StatLearning.com <www.StatLearning.com>`__, Springer-Verlag, New York Examples ~~~~~~~~ :: summary(Carseats) lm.fit=lm(Sales~Advertising+Price,data=Carseats)

Multiple linear regression to predict Sales using Price, Urban, and US.

import statsmodels.formula.api as smf model = smf.ols(formula="Sales ~ Price + Urban + US", data=carseats.data).fit() print(model.summary())

OLS Regression Results

==============================================================================

Dep. Variable: Sales R-squared: 0.239

Model: OLS Adj. R-squared: 0.234

Method: Least Squares F-statistic: 41.52

Date: Thu, 28 May 2020 Prob (F-statistic): 2.39e-23

Time: 18:21:58 Log-Likelihood: -927.66

No. Observations: 400 AIC: 1863.

Df Residuals: 396 BIC: 1879.

Df Model: 3

Covariance Type: nonrobust

================================================================================

coef std err t P>|t| [0.025 0.975]

--------------------------------------------------------------------------------

Intercept 13.0435 0.651 20.036 0.000 11.764 14.323

Urban[T.Yes] -0.0219 0.272 -0.081 0.936 -0.556 0.512

US[T.Yes] 1.2006 0.259 4.635 0.000 0.691 1.710

Price -0.0545 0.005 -10.389 0.000 -0.065 -0.044

==============================================================================

Omnibus: 0.676 Durbin-Watson: 1.912

Prob(Omnibus): 0.713 Jarque-Bera (JB): 0.758

Skew: 0.093 Prob(JB): 0.684

Kurtosis: 2.897 Cond. No. 628.

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The F-statistic is larger than 1, though much smaller compared to the F-statistics in the last problem. I think this means that the alternative hypothesis is viable, but not completely sure about that.

From the individual p-values we can conclude that Urban is not a statistically

significant predictor for Sales.

Interpretation of coefficient of predictors

Since Urban is not a statistically significant predictor we do not need to

worry about its coefficient. The coefficient for US indicates that if the

store is in the US then it then the sales will increase by about 1200 units. On

the other hand the coefficient for Price says that an increase in price will

result in a decrease in sales.

Linear model equation

The equation for this model is

\begin{align} Y = 13.04 - 0.02 X_1 + 1.20 X_2 - 0.05 X_3, \end{align}

where \(Y\), \(X_1\), \(X_2\), and \(X_3\) stand for Sales, Urban, US, and

Price, respectively. \(X_1 = 1\) if the store is an urban location, and \(0\)

otherwise. Similarly \(X_2 = 1\) if the store is in the US, and \(0\) if it is

not.

Null hypothesis rejection

We can reject the null hypothesis for US, and Price, since the associated

p-values are effectively 0.

Smaller multiple linear model for Carseats sales

small_model = smf.ols(formula="Sales ~ US + Price", data=carseats.data).fit() print(small_model.summary())

OLS Regression Results

==============================================================================

Dep. Variable: Sales R-squared: 0.239

Model: OLS Adj. R-squared: 0.235

Method: Least Squares F-statistic: 62.43

Date: Thu, 28 May 2020 Prob (F-statistic): 2.66e-24

Time: 18:45:15 Log-Likelihood: -927.66

No. Observations: 400 AIC: 1861.

Df Residuals: 397 BIC: 1873.

Df Model: 2

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 13.0308 0.631 20.652 0.000 11.790 14.271

US[T.Yes] 1.1996 0.258 4.641 0.000 0.692 1.708

Price -0.0545 0.005 -10.416 0.000 -0.065 -0.044

==============================================================================

Omnibus: 0.666 Durbin-Watson: 1.912

Prob(Omnibus): 0.717 Jarque-Bera (JB): 0.749

Skew: 0.092 Prob(JB): 0.688

Kurtosis: 2.895 Cond. No. 607.

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

Based on the \(R^2\) values both the models fit the data similarly.

Confidence intervals of fitted parameters

print(small_model.conf_int())

0 1

Intercept 11.79032 14.271265

US[T.Yes] 0.69152 1.707766

Price -0.06476 -0.044195

The confidence intervals are also printed in the summary, but this is probably more convenient.

Outliers and leverages

To see if there are any leverage points we need to first calculate the average leverage, \((p + 1) / n\), for the data.

npredictors = 2 nobservations = len(carseats.data) avg_leverage = (npredictors + 1) / nobservations print(f"Average leverage: {avg_leverage}")

Average leverage: 0.0075

The Residuals vs Leverage plot is the easiest way to check for outliers and high leverage observations.

import matplotlib.pyplot as plt import seaborn as sns sns.set_style("ticks") plt.close("all") fig, ax = plt.subplots() rlplot = sm.graphics.influence_plot(small_model, criterion="Cooks", ax=ax) sns.despine() ax.set_xlabel("Leverage") ax.set_ylabel("Standardized Residuals") ax.set_title(" ") fig.savefig("img/3.10.h_res_vs_lev.png", dpi=90)

All the residuals are between -3 and 3, so there are no outliers. However there are a lot of points whose leverage greatly exceeds the average leverage. Thus there are high leverage observations.

Question 11

Simple linear regression with synthetic data

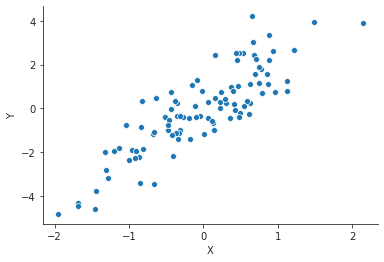

import pandas as pd import numpy as np import matplotlib.pyplot as plt import seaborn as sns sns.set_style("ticks") rng = np.random.default_rng(seed=42) x = rng.normal(size=100) y = 2 * x + rng.normal(size=100) data = pd.DataFrame({"X" : x, "Y" : y}) plt.close("all") fig, ax = plt.subplots() sp = sns.scatterplot(x="X", y="Y", data=data, ax=ax) sns.despine() fig.savefig("img/3.11.a_data.png", dpi=90)

Now we do a simple linear regression with this synthetic data. This model will not have an intercept: \(Y = βX\).

import statsmodels.formula.api as smf model = smf.ols("Y ~ X - 1", data=data).fit() print(model.summary())

OLS Regression Results

=======================================================================================

Dep. Variable: Y R-squared (uncentered): 0.741

Model: OLS Adj. R-squared (uncentered): 0.738

Method: Least Squares F-statistic: 283.3

Date: Fri, 29 May 2020 Prob (F-statistic): 8.30e-31

Time: 07:28:26 Log-Likelihood: -138.87

No. Observations: 100 AIC: 279.7

Df Residuals: 99 BIC: 282.4

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

X 2.1196 0.126 16.833 0.000 1.870 2.369

==============================================================================

Omnibus: 2.995 Durbin-Watson: 1.681

Prob(Omnibus): 0.224 Jarque-Bera (JB): 2.970

Skew: 0.408 Prob(JB): 0.227

Kurtosis: 2.787 Cond. No. 1.00

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The coefficient estimate is \(\hat{β} = 2.1196\) with a standard error of \(0.126\). The t-statistic is 16.833 and the associated p-value is 0. This means we can reject the null hypothesis.

Inverse simple linear relation with synthetic data

We are going to use the same data, but now with X as the response and Y as

the predictor.

model2 = smf.ols("X ~ Y - 1", data=data).fit() print(model2.summary())

OLS Regression Results

=======================================================================================

Dep. Variable: X R-squared (uncentered): 0.741

Model: OLS Adj. R-squared (uncentered): 0.738

Method: Least Squares F-statistic: 283.3

Date: Fri, 29 May 2020 Prob (F-statistic): 8.30e-31

Time: 07:36:14 Log-Likelihood: -48.770

No. Observations: 100 AIC: 99.54

Df Residuals: 99 BIC: 102.1

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Y 0.3496 0.021 16.833 0.000 0.308 0.391

==============================================================================

Omnibus: 1.369 Durbin-Watson: 1.557

Prob(Omnibus): 0.504 Jarque-Bera (JB): 1.145

Skew: -0.020 Prob(JB): 0.564

Kurtosis: 2.477 Cond. No. 1.00

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The coefficient estimate is \(\hat{β} = 0.3496\) with a standard error of \(0.021\). The t-statistic is \(16.833\) and the associated p-value is 0. This means we can reject the null hypothesis.

Relation between the two regressions

Given the underlying true model we should have expected that the coefficients of the two models would be multiplicative inverses of each other. But they are not. The reason being that the two models are minimizing different residual sum of squares. For the two models the residual sum of squares are

\begin{align} \mathrm{RSS}^{(1)} &= ∑_{i=1}^n (y_i - \hat{β}^(1) x_i)^2, \\ \mathrm{RSS}^{(2)} &= ∑_{i=1}^n (x_i - \hat{β}^(2) y_i)^2, \end{align}respectively. \(\mathrm{RSS}^(1)\) is minimized when \(\hat{β}^(1) = ∑y_i x_i / ∑ x_i^2\), and \(\mathrm{RSS}^(2)\) is minimized when \(\hat{β}^(2) = ∑x_i y_i / ∑ y_i^2\). If \(\hat{β}^(1) = 1 / \hat{β}^(2)\) then we have

\begin{align} (∑_{i=1}^n x_i y_i)^2 = ∑_{i=1}^n x_i^2 ∑_{i=1}^n y_i^2. \end{align}Since here \(X\) and \(Y\) are random variables with zero mean we can interpret the above equation as

\begin{align} \mathrm{Cov}(X, Y) = \mathrm{Var}(X) \mathrm{Var}(Y). \end{align}This is true only if the true relation is \(y_i = β x_i + γ\) for some nonzero constants \(β\) and \(γ\) (See DeGroot and Schervish, Theorem 4.6.3, or ProofWiki for a proof of this statement.). But the true relation in this case was \(y_i = β x_i + ϵ\), where \(ϵ\) is a Gaussian random variable with zero mean. Thus the above statement is not true, and hence \(\hat{β}^(1) ≠ 1 / \hat{β}^(2)\). For a more detailed discussion on this check Stats StackExchange.

t-statistic for first model

The t-statistic for a simple linear fit without intercept is \(\hat{β} / \mathrm{SE}(\hat{β})\) where \(\hat{β} = ∑_i x_i y_i / ∑_i x_i^2\), and the standard error is

\begin{align} \mathrm{SE}(\hat{β} = \frac{\sqrt{∑_i (y_i - x_i \hat{β})^2}}{(n-1) ∑_i x_i^2}. \end{align}Substituting the expression for \(\hat{β}\) in to the expressions for the standard error and the t-statistic gives us the expected expression for the t-statistic. The trick is to realize that the summation indices are dummy variables, i.e. \(∑_{i=1}^n x_i^2 = ∑_{j=1}^n x_j^2\). Numerically we can conform this as follows:

n = len(data) x, y = data["X"], data["Y"] t = (np.sqrt(n - 1) * np.sum(x * y) / np.sqrt(np.sum(x ** 2) * np.sum(y ** 2) - np.sum(x * y) ** 2)) print(f"t-statistic: {t:.3f}")

t-statistic: 16.833

t-statistic for second model

The expression for the t-statistic is symmetric in \(X\) and \(Y\), so irrespective of whether we are regressing \(Y\) onto \(X\) or \(X\) onto \(Y\), we will have the same t-statistic.

t-statistic for models with intercept

model3 = smf.ols(formula="Y ~ X", data=data).fit() model4 = smf.ols(formula="X ~ Y", data=data).fit()

print(model3.summary())

OLS Regression Results

==============================================================================

Dep. Variable: Y R-squared: 0.740

Model: OLS Adj. R-squared: 0.738

Method: Least Squares F-statistic: 279.2

Date: Sat, 30 May 2020 Prob (F-statistic): 1.94e-30

Time: 00:26:31 Log-Likelihood: -138.87

No. Observations: 100 AIC: 281.7

Df Residuals: 98 BIC: 287.0

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -0.0046 0.098 -0.047 0.962 -0.200 0.190

X 2.1192 0.127 16.709 0.000 1.867 2.371

==============================================================================

Omnibus: 2.996 Durbin-Watson: 1.682

Prob(Omnibus): 0.224 Jarque-Bera (JB): 2.971

Skew: 0.409 Prob(JB): 0.226

Kurtosis: 2.787 Cond. No. 1.30

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

print(model4.summary())

OLS Regression Results

==============================================================================

Dep. Variable: X R-squared: 0.740

Model: OLS Adj. R-squared: 0.738

Method: Least Squares F-statistic: 279.2

Date: Sat, 30 May 2020 Prob (F-statistic): 1.94e-30

Time: 00:26:47 Log-Likelihood: -48.728

No. Observations: 100 AIC: 101.5

Df Residuals: 98 BIC: 106.7

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -0.0114 0.040 -0.287 0.775 -0.091 0.068

Y 0.3493 0.021 16.709 0.000 0.308 0.391

==============================================================================

Omnibus: 1.373 Durbin-Watson: 1.559

Prob(Omnibus): 0.503 Jarque-Bera (JB): 1.146

Skew: -0.018 Prob(JB): 0.564

Kurtosis: 2.477 Cond. No. 1.91

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

We can see that the t-coefficient for the predictors is same for both models.

Question 12

Equal regression coefficients

As this is a regression without intercept we can use the expressions derived in the previous question. The coefficients will be same when \(∑_i x_i^2 = ∑_i y_i^2\). This is particularly true when \(X = Y\).

Different coefficient estimates - numerical

Essentially reusing question 11.

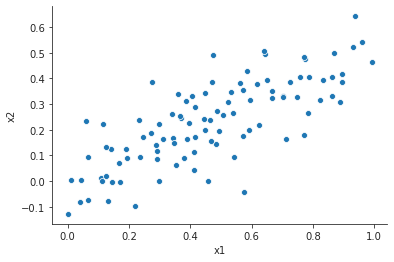

rng = np.random.default_rng(seed=42) x = rng.normal(size=100) y = 2 * x + rng.normal(size=100) data = pd.DataFrame({"X" : x, "Y" : y}) plt.close("all") fig, ax = plt.subplots() sp = sns.scatterplot(x="X", y="Y", data=data, ax=ax) sns.despine() fig.savefig("img/3.12.b_data.png", dpi=90)

model1 = smf.ols("Y ~ X - 1", data=data).fit() model2 = smf.ols("X ~ Y - 1", data=data).fit()

print(model1.summary())

OLS Regression Results

=======================================================================================

Dep. Variable: Y R-squared (uncentered): 0.741

Model: OLS Adj. R-squared (uncentered): 0.738

Method: Least Squares F-statistic: 283.3

Date: Sat, 30 May 2020 Prob (F-statistic): 8.30e-31

Time: 00:47:09 Log-Likelihood: -138.87

No. Observations: 100 AIC: 279.7

Df Residuals: 99 BIC: 282.4

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

X 2.1196 0.126 16.833 0.000 1.870 2.369

==============================================================================

Omnibus: 2.995 Durbin-Watson: 1.681

Prob(Omnibus): 0.224 Jarque-Bera (JB): 2.970

Skew: 0.408 Prob(JB): 0.227

Kurtosis: 2.787 Cond. No. 1.00

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

print(model2.summary())

OLS Regression Results

=======================================================================================

Dep. Variable: X R-squared (uncentered): 0.741

Model: OLS Adj. R-squared (uncentered): 0.738

Method: Least Squares F-statistic: 283.3

Date: Sat, 30 May 2020 Prob (F-statistic): 8.30e-31

Time: 00:47:17 Log-Likelihood: -48.770

No. Observations: 100 AIC: 99.54

Df Residuals: 99 BIC: 102.1

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Y 0.3496 0.021 16.833 0.000 0.308 0.391

==============================================================================

Omnibus: 1.369 Durbin-Watson: 1.557

Prob(Omnibus): 0.504 Jarque-Bera (JB): 1.145

Skew: -0.020 Prob(JB): 0.564

Kurtosis: 2.477 Cond. No. 1.00

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

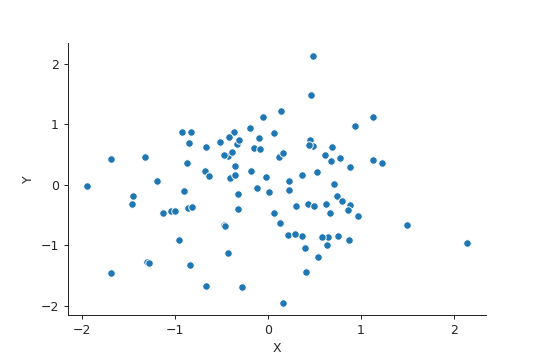

Same coefficient estimates - numerical

We need \(∑_i x_i^2 = ∑_i y_i^2\). Setting \(X = Y\) works, but \(Y = \mathrm{Permutation}(X)\) would work too, and is more general.

rng = np.random.default_rng(seed=42) x = rng.normal(size=100) y = np.random.permutation(x) data = pd.DataFrame({"X" : x, "Y" : y}) plt.close("all") fig, ax = plt.subplots() sp = sns.scatterplot(x="X", y="Y", data=data, ax=ax) sns.despine() fig.savefig("img/3.12.b_data.png", dpi=90)

model3 = smf.ols("Y ~ X - 1", data=data).fit() model4 = smf.ols("X ~ Y - 1", data=data).fit()

print(model3.summary())

OLS Regression Results

=======================================================================================

Dep. Variable: Y R-squared (uncentered): 0.002

Model: OLS Adj. R-squared (uncentered): -0.008

Method: Least Squares F-statistic: 0.2018

Date: Sat, 30 May 2020 Prob (F-statistic): 0.654

Time: 00:52:14 Log-Likelihood: -116.23

No. Observations: 100 AIC: 234.5

Df Residuals: 99 BIC: 237.1

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

X 0.0451 0.100 0.449 0.654 -0.154 0.244

==============================================================================

Omnibus: 0.651 Durbin-Watson: 1.772

Prob(Omnibus): 0.722 Jarque-Bera (JB): 0.787

Skew: -0.142 Prob(JB): 0.675

Kurtosis: 2.671 Cond. No. 1.00

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

print(model4.summary())

OLS Regression Results

=======================================================================================

Dep. Variable: X R-squared (uncentered): 0.002

Model: OLS Adj. R-squared (uncentered): -0.008

Method: Least Squares F-statistic: 0.2018

Date: Sat, 30 May 2020 Prob (F-statistic): 0.654

Time: 00:52:20 Log-Likelihood: -116.23

No. Observations: 100 AIC: 234.5

Df Residuals: 99 BIC: 237.1

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Y 0.0451 0.100 0.449 0.654 -0.154 0.244

==============================================================================

Omnibus: 0.296 Durbin-Watson: 1.833

Prob(Omnibus): 0.862 Jarque-Bera (JB): 0.446

Skew: -0.105 Prob(JB): 0.800

Kurtosis: 2.749 Cond. No. 1.00

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

Question 13

Feature vector

rng = np.random.default_rng(seed=42) x = rng.normal(loc=0, scale=1, size=100)

Error vector

eps = rng.normal(loc=0, scale=0.25, size=100)

Response vector

y = -1 + 0.5 * x + eps

The length of y is 100, and \(β_0 = -1\), and \(β_1 = 0.5\).

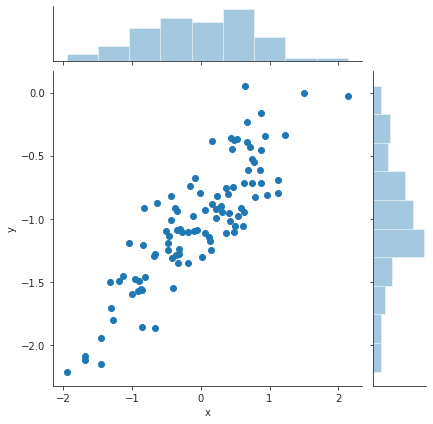

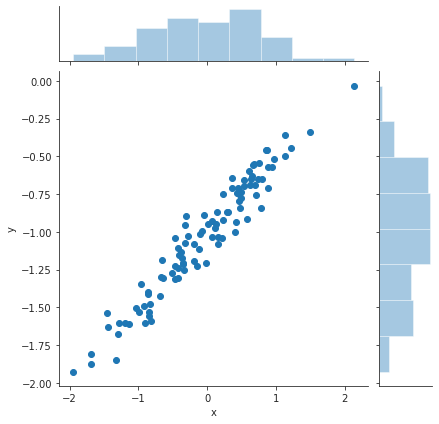

Scatter plot

df = pd.DataFrame({"x" : x, "y" : y}) plt.close("all") sp = sns.jointplot(x="x", y="y", data=df) # jointplot also gives the distributions of x and y in addition to the scatter plot sns.despine() sp.savefig("img/3.13.d_scatter.png", dpi=90)

We can see a clear linear trend between x and y.

Least squares fit

model = smf.ols("y ~ x", data=df).fit() print(model.summary())

OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.740

Model: OLS Adj. R-squared: 0.738

Method: Least Squares F-statistic: 279.2

Date: Sat, 30 May 2020 Prob (F-statistic): 1.94e-30

Time: 03:07:58 Log-Likelihood: -0.24351

No. Observations: 100 AIC: 4.487

Df Residuals: 98 BIC: 9.697

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -1.0012 0.025 -40.774 0.000 -1.050 -0.952

x 0.5298 0.032 16.709 0.000 0.467 0.593

==============================================================================

Omnibus: 2.996 Durbin-Watson: 1.682

Prob(Omnibus): 0.224 Jarque-Bera (JB): 2.971

Skew: 0.409 Prob(JB): 0.226

Kurtosis: 2.787 Cond. No. 1.30

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

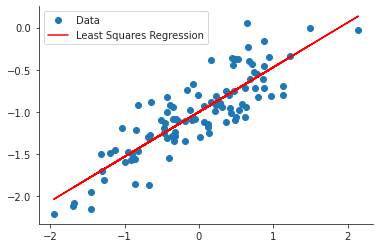

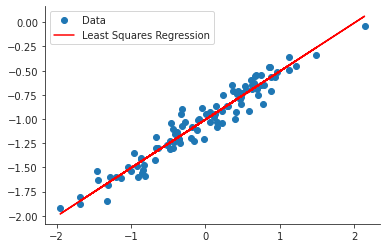

The estimates for \(β_0\) and \(β_1\) are almost equal to the true values. The true values fall within the 95% confidence interval of the estimated values.

ypred = model.predict(df["x"]) plt.close("all") fig, ax = plt.subplots() ax.plot(x, y, 'o', label="Data") ax.plot(x, ypred, 'r', label="Least Squares Regression") ax.legend(loc="best") sns.despine() fig.savefig("img/3.13.f_ols.png", dpi=90)

Polynomial regression

poly_model = smf.ols(formula="y ~ x + I(x**2)", data=df).fit() print(poly_model.summary())

OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.746

Model: OLS Adj. R-squared: 0.741

Method: Least Squares F-statistic: 142.6

Date: Sat, 30 May 2020 Prob (F-statistic): 1.30e-29

Time: 03:32:56 Log-Likelihood: 0.93852

No. Observations: 100 AIC: 4.123

Df Residuals: 97 BIC: 11.94

Df Model: 2

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -0.9732 0.031 -31.881 0.000 -1.034 -0.913

x 0.5200 0.032 16.177 0.000 0.456 0.584

I(x ** 2) -0.0474 0.031 -1.523 0.131 -0.109 0.014

==============================================================================

Omnibus: 2.591 Durbin-Watson: 1.731

Prob(Omnibus): 0.274 Jarque-Bera (JB): 2.542

Skew: 0.380 Prob(JB): 0.281

Kurtosis: 2.818 Cond. No. 2.08

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The \(R^2\) values of both the models are pretty much the same. Additionally the p-value of the quadratic term is not zero. The quadratic term does not improve the model fit.

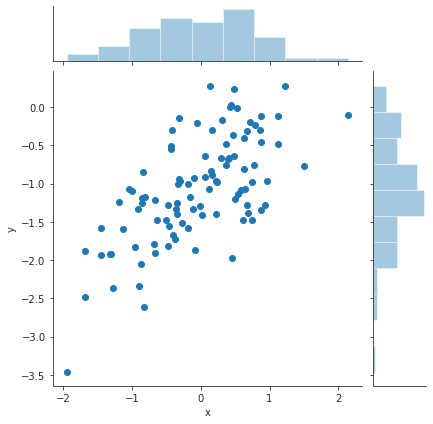

Least squares fit with less noise

The new data is as follows. The spread of the noise is now 0.1 instead of 0.25.

eps = rng.normal(loc=0, scale=0.1, size=100) y = -1 + 0.5 * x + eps df2 = pd.DataFrame({"x" : x, "y" : y}) plt.close("all") sp = sns.jointplot(x="x", y="y", data=df2) # jointplot also gives the distributions of x and y in addition to the scatter plot sns.despine() sp.savefig("img/3.13.h_scatter.png", dpi=90)

Now the least squares fit to this data.

less_noisy_model = smf.ols("y ~ x", data=df2).fit() print(less_noisy_model.summary())

OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.935

Model: OLS Adj. R-squared: 0.934

Method: Least Squares F-statistic: 1403.

Date: Sat, 30 May 2020 Prob (F-statistic): 7.01e-60

Time: 03:39:50 Log-Likelihood: 86.452

No. Observations: 100 AIC: -168.9

Df Residuals: 98 BIC: -163.7

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -1.0063 0.010 -97.523 0.000 -1.027 -0.986

x 0.4991 0.013 37.458 0.000 0.473 0.526

==============================================================================

Omnibus: 3.211 Durbin-Watson: 1.893

Prob(Omnibus): 0.201 Jarque-Bera (JB): 2.554

Skew: 0.345 Prob(JB): 0.279

Kurtosis: 3.371 Cond. No. 1.30

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The \(R^2\) value for this data set is much larger than the original data set. The model is able to explain 93% of the less noisy data, whereas it could only explain around 70% of the original data set.

ypred = less_noisy_model.predict(df2["x"]) plt.close("all") fig, ax = plt.subplots() ax.plot(x, y, 'o', label="Data") ax.plot(x, ypred, 'r', label="Least Squares Regression") ax.legend(loc="best") sns.despine() fig.savefig("img/3.13.h_ols.png", dpi=90)

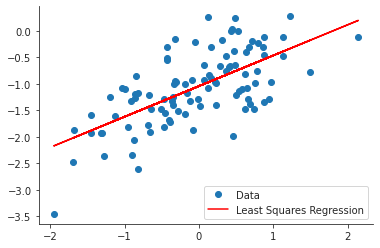

Least squares fit with more noise

The new data is as follows. The spread of the noise is now 0.5 instead of 0.25.

eps = rng.normal(loc=0, scale=0.5, size=100) y = -1 + 0.5 * x + eps df3 = pd.DataFrame({"x" : x, "y" : y}) plt.close("all") sp = sns.jointplot(x="x", y="y", data=df3) sns.despine() sp.savefig("img/3.13.i_scatter.png", dpi=90)

Now the least squares fit to this data.

more_noisy_model = smf.ols("y ~ x", data=df3).fit() print(more_noisy_model.summary())

OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.430

Model: OLS Adj. R-squared: 0.424

Method: Least Squares F-statistic: 74.01

Date: Sat, 30 May 2020 Prob (F-statistic): 1.29e-13

Time: 03:45:50 Log-Likelihood: -75.586

No. Observations: 100 AIC: 155.2

Df Residuals: 98 BIC: 160.4

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -1.0417 0.052 -19.971 0.000 -1.145 -0.938

x 0.5794 0.067 8.603 0.000 0.446 0.713

==============================================================================

Omnibus: 0.119 Durbin-Watson: 1.889

Prob(Omnibus): 0.942 Jarque-Bera (JB): 0.294

Skew: -0.029 Prob(JB): 0.863

Kurtosis: 2.741 Cond. No. 1.30

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The \(R^2\) value for this data set is much smaller than it was for the original data set. The model is able to explain only 43% of the more noisy data, whereas it could explain around 70% of the original data.

ypred = more_noisy_model.predict(df3["x"]) plt.close("all") fig, ax = plt.subplots() ax.plot(x, y, 'o', label="Data") ax.plot(x, ypred, 'r', label="Least Squares Regression") ax.legend(loc="best") sns.despine() fig.savefig("img/3.13.i_ols.png", dpi=90)

From the graph it appears that there are possible outliers, which is not surprising given the spread of the error.

Confidence intervals of the three models

print("Confidence interval based on original data set:\n") print(f"{model.conf_int()}\n") print("Confidence interval based on less noisy data set:\n") print(f"{less_noisy_model.conf_int()}\n") print("Confidence interval based on more noisy data set:\n") print(f"{more_noisy_model.conf_int()}\n")

Confidence interval based on original data set:

0 1

Intercept -1.049887 -0.952433

x 0.466873 0.592714

Confidence interval based on less noisy data set:

0 1

Intercept -1.026756 -0.985803

x 0.472653 0.525535

Confidence interval based on more noisy data set:

0 1

Intercept -1.145197 -0.938180

x 0.445752 0.713071

The confidence intervals for the less noisy data set are the tightest and the confidence intervals for the more noisy data set are the loosest.

Question 14

Multiple linear model with collinearity

from numpy.random import MT19937 rng = np.random.default_rng(MT19937(seed=5)) x1 = rng.uniform(size=100) x2 = 0.5 * x1 + rng.normal(size=100) / 10 y = 2 + 2 * x1 + 0.3 * x2 + rng.normal(size=100) df_coll = pd.DataFrame({"x1" : x1, "x2" : x2, "y" : y})

The form of the linear model is

\begin{align} Y = 2 + 2 X_1 + 0.3 X_2 + ϵ. \end{align}Correlation scatter plot

corr = df_coll.corr() print(corr)

x1 x2 y

x1 1.00000 0.76818 0.55569

x2 0.76818 1.00000 0.45415

y 0.55569 0.45415 1.00000

The correlation between x1 and x2 is 0.768.

plt.close("all") fig, ax = plt.subplots() sp = sns.scatterplot(x="x1", y="x2", data=df_coll, ax=ax) sns.despine() fig.savefig("img/3.14.a_scatter.png", dpi=90)

Least squares fit with x1 and x2

coll_model1 = smf.ols("y ~ x1 + x2", data=df_coll).fit() print(coll_model1.summary())

OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.311

Model: OLS Adj. R-squared: 0.296

Method: Least Squares F-statistic: 21.85

Date: Sat, 30 May 2020 Prob (F-statistic): 1.46e-08

Time: 04:51:30 Log-Likelihood: -133.37

No. Observations: 100 AIC: 272.7

Df Residuals: 97 BIC: 280.6

Df Model: 2

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 1.8690 0.194 9.651 0.000 1.485 2.253

x1 2.1749 0.568 3.832 0.000 1.048 3.301

x2 0.4454 0.881 0.505 0.614 -1.304 2.194

==============================================================================

Omnibus: 0.484 Durbin-Watson: 1.964

Prob(Omnibus): 0.785 Jarque-Bera (JB): 0.623

Skew: -0.140 Prob(JB): 0.732

Kurtosis: 2.734 Cond. No. 12.2

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The estimated values for the coefficients are 1.869, 2.175, and 0.445 which are close to the true values, albeit with large standard errors, particularly for \(\hat{β}_2\). Based on the p-values we can reject the null hypothesis for \(β_1\), but we cannot reject the null-hypothesis for \(β_2\).

Least squares fit with x1 only

coll_model2 = smf.ols("y ~ x1", data=df_coll).fit() print(coll_model2.summary())

OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.309

Model: OLS Adj. R-squared: 0.302

Method: Least Squares F-statistic: 43.78

Date: Sat, 30 May 2020 Prob (F-statistic): 1.96e-09

Time: 04:51:44 Log-Likelihood: -133.50

No. Observations: 100 AIC: 271.0

Df Residuals: 98 BIC: 276.2

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 1.8690 0.193 9.688 0.000 1.486 2.252

x1 2.3952 0.362 6.617 0.000 1.677 3.114

==============================================================================

Omnibus: 0.538 Durbin-Watson: 1.940

Prob(Omnibus): 0.764 Jarque-Bera (JB): 0.650

Skew: -0.160 Prob(JB): 0.723

Kurtosis: 2.768 Cond. No. 4.80

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The coefficient value has increased, and the \(R^2\) value has decreased marginally. We can still reject the null hypothesis based on the p-value.

Least squares fit with x2 only

coll_model3 = smf.ols("y ~ x2", data=df_coll).fit() print(coll_model3.summary())

OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.206

Model: OLS Adj. R-squared: 0.198

Method: Least Squares F-statistic: 25.46

Date: Sat, 30 May 2020 Prob (F-statistic): 2.08e-06

Time: 04:51:59 Log-Likelihood: -140.42

No. Observations: 100 AIC: 284.8

Df Residuals: 98 BIC: 290.0

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 2.2853 0.171 13.355 0.000 1.946 2.625

x2 3.0393 0.602 5.046 0.000 1.844 4.235

==============================================================================

Omnibus: 0.036 Durbin-Watson: 2.117

Prob(Omnibus): 0.982 Jarque-Bera (JB): 0.064

Skew: -0.038 Prob(JB): 0.969

Kurtosis: 2.902 Cond. No. 6.38

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The coefficient value is much larger now, but the \(R^2\) value has decreased. We can now reject the null hypothesis based on the p-value.

Contradiction of models

The three models do not contradict each other. Due to the high correlation

between x1 and x2, we can predict x2 from x1. Thus in the original model

x2 has very little explanatory power and so we cannot reject the null

hypothesis for \(β_2\).

For the second and third model the explanation for the

increase in the coefficients is as follows. In the second model we are

expressing x2 in terms of x1, and so the coefficient of x1 in the

expression for y increases to 2.3. In the third model we are expressing x1

in terms of x2, and so the coefficient of x2 in the expression for y

increases to 4.3. The 95% confidence interval of the second model includes the

new true value of the coefficient. Even though the 95% confidence interval of

the third model does not include the new true value of the coefficient it comes

close. This is probably due to the difference between the random number

generators used by R and numpy.

Additional data

df_coll = df_coll.append({"x1" : 0.1, "x2" : 0.8, "y" : 6}, ignore_index=True) coll_model1 = smf.ols("y ~ x1 + x2", data=df_coll).fit() coll_model2 = smf.ols("y ~ x1", data=df_coll).fit() coll_model3 = smf.ols("y ~ x2", data=df_coll).fit()

print(coll_model1.summary())

OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.295

Model: OLS Adj. R-squared: 0.281

Method: Least Squares F-statistic: 20.50

Date: Sat, 30 May 2020 Prob (F-statistic): 3.66e-08

Time: 04:56:57 Log-Likelihood: -138.91

No. Observations: 101 AIC: 283.8

Df Residuals: 98 BIC: 291.7

Df Model: 2

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 1.9525 0.200 9.769 0.000 1.556 2.349

x1 1.2762 0.508 2.514 0.014 0.269 2.283

x2 2.0004 0.753 2.657 0.009 0.506 3.495

==============================================================================

Omnibus: 0.020 Durbin-Watson: 2.024

Prob(Omnibus): 0.990 Jarque-Bera (JB): 0.144

Skew: 0.018 Prob(JB): 0.931

Kurtosis: 2.819 Cond. No. 9.92

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

print(coll_model2.summary())

OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.244

Model: OLS Adj. R-squared: 0.237

Method: Least Squares F-statistic: 31.98

Date: Sat, 30 May 2020 Prob (F-statistic): 1.51e-07

Time: 04:57:04 Log-Likelihood: -142.43

No. Observations: 101 AIC: 288.9

Df Residuals: 99 BIC: 294.1

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 2.0051 0.205 9.786 0.000 1.599 2.412

x1 2.1847 0.386 5.655 0.000 1.418 2.951

==============================================================================

Omnibus: 6.115 Durbin-Watson: 1.839

Prob(Omnibus): 0.047 Jarque-Bera (JB): 7.252

Skew: 0.308 Prob(JB): 0.0266

Kurtosis: 4.160 Cond. No. 4.76

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

print(coll_model3.summary())

OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.249

Model: OLS Adj. R-squared: 0.242

Method: Least Squares F-statistic: 32.90

Date: Sat, 30 May 2020 Prob (F-statistic): 1.06e-07

Time: 04:57:12 Log-Likelihood: -142.07

No. Observations: 101 AIC: 288.1

Df Residuals: 99 BIC: 293.4

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 2.2419 0.168 13.365 0.000 1.909 2.575

x2 3.2762 0.571 5.736 0.000 2.143 4.409

==============================================================================

Omnibus: 0.044 Durbin-Watson: 2.139

Prob(Omnibus): 0.978 Jarque-Bera (JB): 0.040

Skew: -0.033 Prob(JB): 0.980

Kurtosis: 2.927 Cond. No. 6.09

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

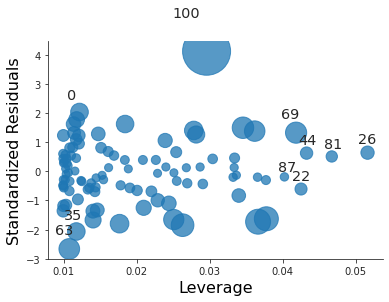

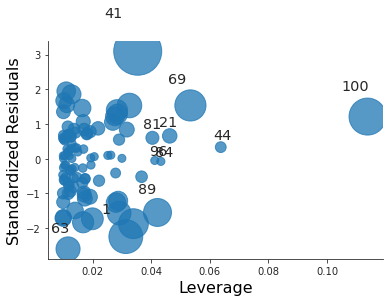

The \(R^2\) values for models 1 and 2 decreased. This observation decreased the predictive power of the models. The average leverage for the data set is

p = len(df_coll.columns) n = len(df_coll) lev = (p + 1) / n print(f"{lev:.3f}")

0.040

plt.close("all") fig, ax = plt.subplots() rlplot = sm.graphics.influence_plot(coll_model1, criterion="Cooks", ax=ax) sns.despine() ax.set_xlabel("Leverage") ax.set_ylabel("Standardized Residuals") ax.set_title(" ") fig.savefig("img/3.14.g_coll1_res_vs_lev.png", dpi=90)

For the first model it is both an outlier and a high leverage point.

plt.close("all") fig, ax = plt.subplots() rlplot = sm.graphics.influence_plot(coll_model2, criterion="Cooks", ax=ax) sns.despine() ax.set_xlabel("Leverage") ax.set_ylabel("Standardized Residuals") ax.set_title(" ") fig.savefig("img/3.14.g_coll2_res_vs_lev.png", dpi=90)

For the second model it is just an outlier.

plt.close("all") fig, ax = plt.subplots() rlplot = sm.graphics.influence_plot(coll_model3, criterion="Cooks", ax=ax) sns.despine() ax.set_xlabel("Leverage") ax.set_ylabel("Standardized Residuals") ax.set_title(" ") fig.savefig("img/3.14.g_coll3_res_vs_lev.png", dpi=90)

For the third model it is just an high leverage point.

Question 15

Predict per capita crime rate with the Boston data set

We load the Boston from statsmodels.

import statsmodels.api as sm boston = sm.datasets.get_rdataset("Boston", "MASS") print(boston.__doc__)

+--------+-----------------+ | Boston | R Documentation | +--------+-----------------+ Housing Values in Suburbs of Boston ----------------------------------- Description ~~~~~~~~~~~ The ``Boston`` data frame has 506 rows and 14 columns. Usage ~~~~~ :: Boston Format ~~~~~~ This data frame contains the following columns: ``crim`` per capita crime rate by town. ``zn`` proportion of residential land zoned for lots over 25,000 sq.ft. ``indus`` proportion of non-retail business acres per town. ``chas`` Charles River dummy variable (= 1 if tract bounds river; 0 otherwise). ``nox`` nitrogen oxides concentration (parts per 10 million). ``rm`` average number of rooms per dwelling. ``age`` proportion of owner-occupied units built prior to 1940. ``dis`` weighted mean of distances to five Boston employment centres. ``rad`` index of accessibility to radial highways. ``tax`` full-value property-tax rate per \\$10,000. ``ptratio`` pupil-teacher ratio by town. ``black`` *1000(Bk - 0.63)^2* where *Bk* is the proportion of blacks by town. ``lstat`` lower status of the population (percent). ``medv`` median value of owner-occupied homes in \\$1000s. Source ~~~~~~ Harrison, D. and Rubinfeld, D.L. (1978) Hedonic prices and the demand for clean air. *J. Environ. Economics and Management* **5**, 81–102. Belsley D.A., Kuh, E. and Welsch, R.E. (1980) *Regression Diagnostics. Identifying Influential Data and Sources of Collinearity.* New York: Wiley.

Earlier we are fitted medv to the other predictors, now we will be fitting

crim to the other predictors.

import statsmodels.formula.api as smf df = boston.data predictors = [c for c in df.columns if c != "crim"] simple_models = {p : smf.ols(formula=f"crim ~ {p}", data=df).fit() for p in predictors} print(f"predictor coefficient p-value") for p, model in simple_models.items(): print(f"{p:^9} {model.params[p]:>9,.4f} {model.pvalues[p]:>9,.4f}")

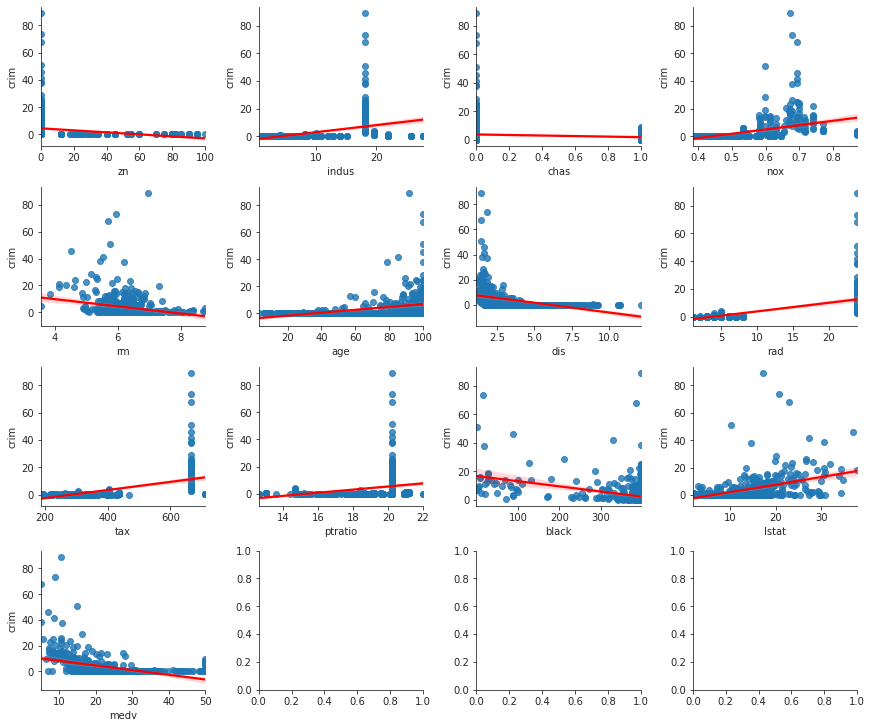

predictor coefficient p-value zn -0.0739 0.0000 indus 0.5098 0.0000 chas -1.8928 0.2094 nox 31.2485 0.0000 rm -2.6841 0.0000 age 0.1078 0.0000 dis -1.5509 0.0000 rad 0.6179 0.0000 tax 0.0297 0.0000 ptratio 1.1520 0.0000 black -0.0363 0.0000 lstat 0.5488 0.0000 medv -0.3632 0.0000

Except for chas everything else appears to be statistically significant.

import matplotlib.pyplot as plt import seaborn as sns from math import ceil sns.set_style("ticks") ncols = 4 nrows = ceil(len(predictors) / ncols) plt.close("all") fig, axs = plt.subplots(nrows=nrows, ncols=ncols, constrained_layout=True, figsize=(12, 10)) for i in range(nrows): for j in range(ncols): if i * ncols + j < len(predictors): sns.regplot(x=df[predictors[i * ncols + j]], y=df["crim"], ax=axs[i, j], line_kws={"color" : "r"}) sns.despine() fig.savefig("img/3.15.a_reg_mat.png", dpi=120)

Multiple regression with Boston data set

Y = df['crim'] X = df[predictors] X = sm.add_constant(X) ml_model = sm.OLS(Y, X).fit() print(ml_model.summary())

OLS Regression Results

==============================================================================

Dep. Variable: crim R-squared: 0.454

Model: OLS Adj. R-squared: 0.440

Method: Least Squares F-statistic: 31.47

Date: Sat, 30 May 2020 Prob (F-statistic): 1.57e-56

Time: 12:26:02 Log-Likelihood: -1653.3

No. Observations: 506 AIC: 3335.

Df Residuals: 492 BIC: 3394.

Df Model: 13

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 17.0332 7.235 2.354 0.019 2.818 31.248

zn 0.0449 0.019 2.394 0.017 0.008 0.082

indus -0.0639 0.083 -0.766 0.444 -0.228 0.100

chas -0.7491 1.180 -0.635 0.526 -3.068 1.570

nox -10.3135 5.276 -1.955 0.051 -20.679 0.052

rm 0.4301 0.613 0.702 0.483 -0.774 1.634

age 0.0015 0.018 0.081 0.935 -0.034 0.037

dis -0.9872 0.282 -3.503 0.001 -1.541 -0.433

rad 0.5882 0.088 6.680 0.000 0.415 0.761

tax -0.0038 0.005 -0.733 0.464 -0.014 0.006

ptratio -0.2711 0.186 -1.454 0.147 -0.637 0.095

black -0.0075 0.004 -2.052 0.041 -0.015 -0.000

lstat 0.1262 0.076 1.667 0.096 -0.023 0.275

medv -0.1989 0.061 -3.287 0.001 -0.318 -0.080

==============================================================================

Omnibus: 666.613 Durbin-Watson: 1.519

Prob(Omnibus): 0.000 Jarque-Bera (JB): 84887.625

Skew: 6.617 Prob(JB): 0.00

Kurtosis: 65.058 Cond. No. 1.58e+04

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.58e+04. This might indicate that there are

strong multicollinearity or other numerical problems.

Based on the p-values we can reject the null hypothesis for dis, rad, and

medv. If we are willing to be less accurate we can also reject the null

hypothesis for zn, nox, black, and lstat.

Comparison plot

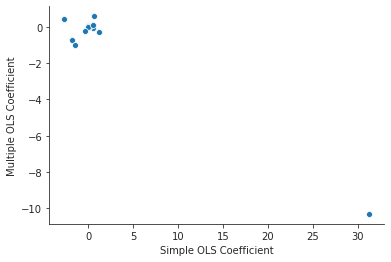

import pandas as pd ml_coefs = ml_model.params sl_coefs = pd.Series({p : simple_models[p].params.loc[p] for p in predictors}) coef_df = pd.concat([sl_coefs, ml_coefs], axis=1) coef_df.reset_index(inplace=True) coef_df.columns = ["Predictors", "Simple OLS Coefficient", "Multiple OLS Coefficient"] coef_df.dropna(inplace=True) print(coef_df)

Predictors Simple OLS Coefficient Multiple OLS Coefficient 0 zn -0.073935 0.044855 1 indus 0.509776 -0.063855 2 chas -1.892777 -0.749134 3 nox 31.248531 -10.313535 4 rm -2.684051 0.430131 5 age 0.107786 0.001452 6 dis -1.550902 -0.987176 7 rad 0.617911 0.588209 8 tax 0.029742 -0.003780 9 ptratio 1.151983 -0.271081 10 black -0.036280 -0.007538 11 lstat 0.548805 0.126211 12 medv -0.363160 -0.198887

plt.close("all") fig, ax = plt.subplots() sns.scatterplot(x="Simple OLS Coefficient", y="Multiple OLS Coefficient", data=coef_df, ax=ax) sns.despine() fig.savefig("img/3.15.c_comp_plot.png")

The coefficients for nox are very different in the two models.

Evidence of non-linear associations

We will use scikit-learn to generate the non-linear features.

from sklearn.preprocessing import PolynomialFeatures pd.options.display.float_format = "{:,.3f}".format Y = df['crim'] poly_features = PolynomialFeatures(degree=3) poly_predictors = {p : poly_features.fit_transform(df[p][:, None]) for p in predictors} poly_models = {p : sm.OLS(Y, poly_predictors[p]).fit() for p in predictors} for p in predictors: print(f"p-values for {p}:") print(f"{poly_models[p].pvalues}\n")